The Rise of Non-Practicing Entity (NPE) Cases Outside the United States

font-size:

While traditionally known as a US trend, patent lawsuits involving NPEs are becoming a global matter as NPEs seek out courts where they can obtain infringer’s profits and/or injunctions. Additionally, patent reform and new legislation in the US to reduce lawsuits brought on by NPEs may motivate NPEs to turn to forums outside of the US.

The following report discusses NPE activities outside of the US. While the rise of cases outside of the US is recent, this report will show how quickly it is growing and how it affects US companies and the firms representing them.

Non-US Cases by Country

NPE cases outside the US are accelerating with over 250 cases in the last five years (Fig. 2). This may seem trivial when compared to the 12,000+ cases filed in the United States. However, close to three-quarters of the non-US NPE cases occurred in 2015 and 2016 alone. Additionally, these non-US figures only represent cases in which the first hearing has been announced or a decision rendered, unlike the US where complaints are counted and a high percentage of cases are settled out of court

Based on available cases, Germany, France and Japan are home to the most NPE cases outside of the US with Germany in a strong lead. This closely follows the trend that German courts see more than two-thirds of all patent litigation held in Europe.

Germany is an attractive country for a patentee for two main reasons. First, Germany is a bifurcated country. A bifurcated system means that infringement and the validity of a patent are decided separately before two different courts. In Germany for example, the patent owner files an infringement lawsuit before a district court; in order to challenge the validity of the patent, the alleged infringer has to file a nullity action before the Bundespatentgericht. However if the district court judge finds infringement and does not stay its judgment on validity, the patent owner is usually granted an injunction even before the decision on validity is rendered[1]. This system makes it patent-owner friendly.

Secondly, Germany (and China, another bifurcated country) offers the best patentee win rate in infringement actions in the countries studied. Darts-ip has calculated that the infringement win rate stays significantly high: 52% in Germany and 58% in China (Fig. 3). This is even considering patents subsequently revoked, partially invalidated or maintained with a reduced scope of protection following an initial victory of the patentee in the corresponding infringement case.

Despite the small number of available NPE cases in China, it has been predicted that China might be the next top forum for NPEs based on this patent-owner friendly system.

Top Courts Outside of the US

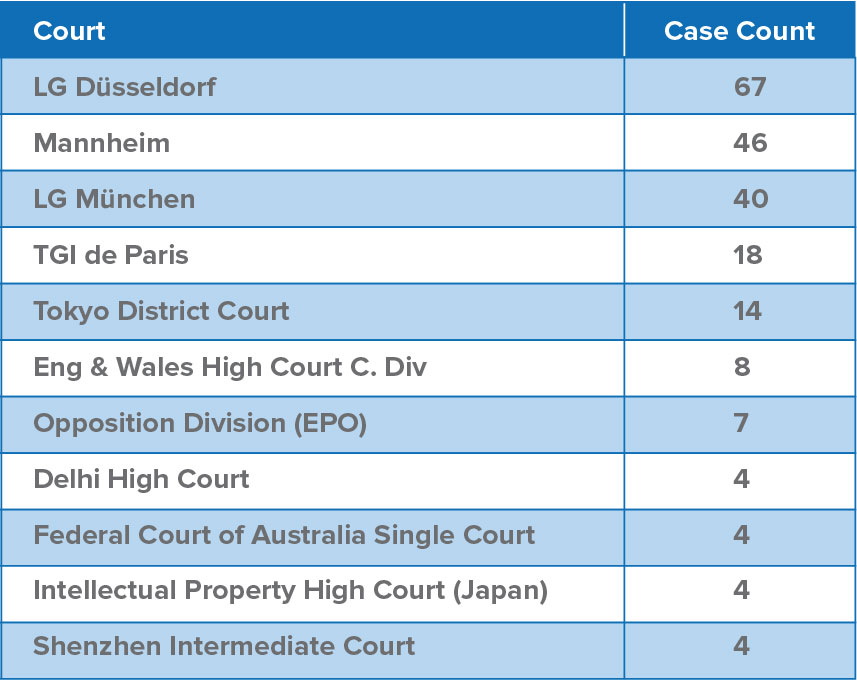

Based on available data, Table 1 includes a list of the top eleven courts NPEs are pursuing based on number of available cases. This may provide information about what courts NPEs prefer and how to be prepared in each jurisdiction..

Table 1: Top Courts Outside the US where NPEs are the plaintiff.

Technology & Industries

Historically, NPEs are known in the US for being aggressive in the technology and telecom industries and increasingly in pharmaceuticals and biotechnology.

So far, NPE cases outside of the US have followed a similar pattern (Fig. 4). Based on the IPC’s of related patents, telecommunications, digital communication, and computer technology dominate these cases.

Additionally, as seen in Fig. 5, the patentee infringement win rate in electronics is higher (compared to life sciences[2], mechanics and chemistry) in Germany, France and China.

Top NPE Defendants Outside the US

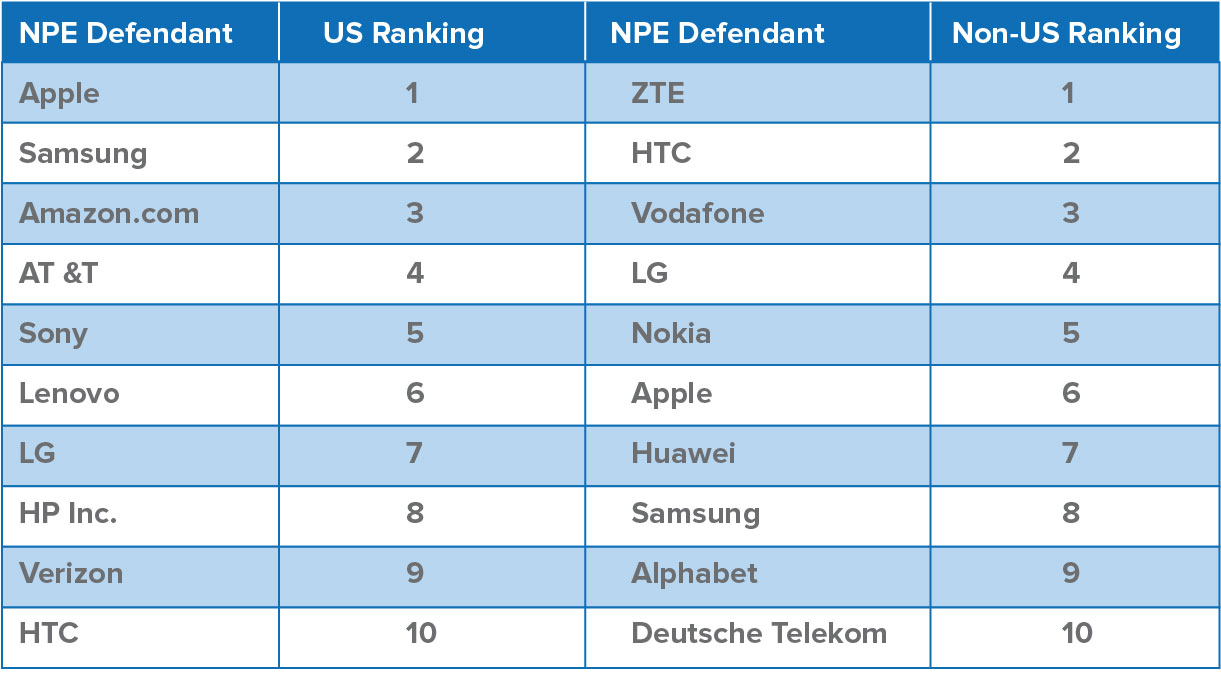

The top NPE defendants are high-tech companies both in the US and outside the US (Table 2). Almost half of the top 10 NPE defendants in the US are also leading defendants outside of the US. Outside of the US, Huawei, Nokia, ZTE, Vodaphone, Google and Deutsche Telekom are being challenged most frequently by NPEs.

Are NPEs Seeing Greater Success Outside of the US?

NPEs have seen a higher win rate outside of the US except for 2015 (Fig. 6). A changing landscape in the US may account for this variation. For example, since 2013, twenty-seven states have enacted Patent Troll Legislation that seeks to punish bad faith patent litigation and encourage Federal action[3].

In addition, the infringement win rate in Germany (where most non-US NPE cases are currently held) is typically higher because it is a bifurcated country. This means that infringement and validity are challenged in different forums. If the judge competent for infringement does not stay validity, cases may occur where a patent is deemed to be infringed before one court even if it is later invalidated before the competent authority. Moreover, the defendant must file another action to challenge the validity of the patent, this additional cost due to the bifurcated system may refrain presumed infringers from challenging the validity of a patent.

How This Affects US Companies and Firms?

Understanding NPE activity around the world can help US operating companies and firms anticipate and track the trends of potential opponents. Tracking industry trends along with the patterns of the NPE’ can help prepare for potential law suits and better understand how aggressive or successful an opponent could be.

US attorneys can also use these foreign cases to find weaknesses in an opponent’s portfolio by following invalidity decisions and arguments made within a relevant industry, patent family, or entity.

The US companies involved in NPE litigation outside of the US are also involved in litigation within the US. It is the responsibility of US firms to understand these trends and help counsel and prepare clients based on these patterns.

Methods: Data Sourced by Darts-ip

Data collected about NPE cases outside of the US was generated by Darts-ip, The Global IP Case Law Database. Darts-ip is the only available platform that allows visibility into patent cases around the world. Data was collected based on cases where an NPE was the plaintiff ranging from January 1, 2011-December 31, 2016.

To help track global patterns associated with NPEs, Darts-ip has also gone through the rigorous process of collecting organizations that meet the characteristics of an NPE to track the activities of NPEs.

Data in this report should be considered a proxy as the completeness and availability of information varies by each country and jurisdiction.

Many countries outside of the US don’t have a systematic or digital way of making cases available. More importantly, privacy laws that differ by country often prohibit the ability to get complete information. For example, in Germany where complaints are not legally accessible, Darts-ip gathers cases by visiting the courts to capture the hearing schedule.

Some countries or courts publish all the relevant information (party names, patent numbers, legal topic etc) and others only make available that party A is filing a case against party B.

Historically, data or discussions available in the US about patent litigation outside of US borders has been limited. Darts-ip, is changing that. By going through the laborious process of collecting and analyzing IP cases across nearly 3,000 courts and 70 countries, darts-ip can help patent professionals get the global insights needed for analyzing global patent trends based on actual cases.

[1] “Global Patent Litigation: How and Where to Win”, 2016 Edition, Michael C. Elmer, C. Gregory Gramenopoulos, pg 21-11

[2] Life sciences includes:

Biotech: (C07G, C07K, C12M, C12N, C12P, C12Q, C12R, C12S) not A61K

Pharmaceuticals: A61K not A61K-008

Organic fine chemistry: C07C, C07D

[3] Jonathan Griffen, National Conference of State Legislatures, 6/15/2016, http://www.ncsl.org/research/financial-services-and-commerce/2015-patent-trolling-legislation.aspx

(309).jpg)

The following report discusses NPE activities outside of the US. While the rise of cases outside of the US is recent, this report will show how quickly it is growing and how it affects US companies and the firms representing them.

Non-US Cases by Country

NPE cases outside the US are accelerating with over 250 cases in the last five years (Fig. 2). This may seem trivial when compared to the 12,000+ cases filed in the United States. However, close to three-quarters of the non-US NPE cases occurred in 2015 and 2016 alone. Additionally, these non-US figures only represent cases in which the first hearing has been announced or a decision rendered, unlike the US where complaints are counted and a high percentage of cases are settled out of court

Based on available cases, Germany, France and Japan are home to the most NPE cases outside of the US with Germany in a strong lead. This closely follows the trend that German courts see more than two-thirds of all patent litigation held in Europe.

(262).jpg)

Germany is an attractive country for a patentee for two main reasons. First, Germany is a bifurcated country. A bifurcated system means that infringement and the validity of a patent are decided separately before two different courts. In Germany for example, the patent owner files an infringement lawsuit before a district court; in order to challenge the validity of the patent, the alleged infringer has to file a nullity action before the Bundespatentgericht. However if the district court judge finds infringement and does not stay its judgment on validity, the patent owner is usually granted an injunction even before the decision on validity is rendered[1]. This system makes it patent-owner friendly.

Secondly, Germany (and China, another bifurcated country) offers the best patentee win rate in infringement actions in the countries studied. Darts-ip has calculated that the infringement win rate stays significantly high: 52% in Germany and 58% in China (Fig. 3). This is even considering patents subsequently revoked, partially invalidated or maintained with a reduced scope of protection following an initial victory of the patentee in the corresponding infringement case.

Despite the small number of available NPE cases in China, it has been predicted that China might be the next top forum for NPEs based on this patent-owner friendly system.

(245).jpg)

Top Courts Outside of the US

Based on available data, Table 1 includes a list of the top eleven courts NPEs are pursuing based on number of available cases. This may provide information about what courts NPEs prefer and how to be prepared in each jurisdiction..

Table 1: Top Courts Outside the US where NPEs are the plaintiff.

Technology & Industries

Historically, NPEs are known in the US for being aggressive in the technology and telecom industries and increasingly in pharmaceuticals and biotechnology.

So far, NPE cases outside of the US have followed a similar pattern (Fig. 4). Based on the IPC’s of related patents, telecommunications, digital communication, and computer technology dominate these cases.

(187).jpg)

Additionally, as seen in Fig. 5, the patentee infringement win rate in electronics is higher (compared to life sciences[2], mechanics and chemistry) in Germany, France and China.

(155).jpg)

Top NPE Defendants Outside the US

The top NPE defendants are high-tech companies both in the US and outside the US (Table 2). Almost half of the top 10 NPE defendants in the US are also leading defendants outside of the US. Outside of the US, Huawei, Nokia, ZTE, Vodaphone, Google and Deutsche Telekom are being challenged most frequently by NPEs.

Are NPEs Seeing Greater Success Outside of the US?

NPEs have seen a higher win rate outside of the US except for 2015 (Fig. 6). A changing landscape in the US may account for this variation. For example, since 2013, twenty-seven states have enacted Patent Troll Legislation that seeks to punish bad faith patent litigation and encourage Federal action[3].

In addition, the infringement win rate in Germany (where most non-US NPE cases are currently held) is typically higher because it is a bifurcated country. This means that infringement and validity are challenged in different forums. If the judge competent for infringement does not stay validity, cases may occur where a patent is deemed to be infringed before one court even if it is later invalidated before the competent authority. Moreover, the defendant must file another action to challenge the validity of the patent, this additional cost due to the bifurcated system may refrain presumed infringers from challenging the validity of a patent.

(115).jpg)

How This Affects US Companies and Firms?

Understanding NPE activity around the world can help US operating companies and firms anticipate and track the trends of potential opponents. Tracking industry trends along with the patterns of the NPE’ can help prepare for potential law suits and better understand how aggressive or successful an opponent could be.

US attorneys can also use these foreign cases to find weaknesses in an opponent’s portfolio by following invalidity decisions and arguments made within a relevant industry, patent family, or entity.

The US companies involved in NPE litigation outside of the US are also involved in litigation within the US. It is the responsibility of US firms to understand these trends and help counsel and prepare clients based on these patterns.

Methods: Data Sourced by Darts-ip

Data collected about NPE cases outside of the US was generated by Darts-ip, The Global IP Case Law Database. Darts-ip is the only available platform that allows visibility into patent cases around the world. Data was collected based on cases where an NPE was the plaintiff ranging from January 1, 2011-December 31, 2016.

To help track global patterns associated with NPEs, Darts-ip has also gone through the rigorous process of collecting organizations that meet the characteristics of an NPE to track the activities of NPEs.

Data in this report should be considered a proxy as the completeness and availability of information varies by each country and jurisdiction.

Many countries outside of the US don’t have a systematic or digital way of making cases available. More importantly, privacy laws that differ by country often prohibit the ability to get complete information. For example, in Germany where complaints are not legally accessible, Darts-ip gathers cases by visiting the courts to capture the hearing schedule.

Some countries or courts publish all the relevant information (party names, patent numbers, legal topic etc) and others only make available that party A is filing a case against party B.

Historically, data or discussions available in the US about patent litigation outside of US borders has been limited. Darts-ip, is changing that. By going through the laborious process of collecting and analyzing IP cases across nearly 3,000 courts and 70 countries, darts-ip can help patent professionals get the global insights needed for analyzing global patent trends based on actual cases.

[1] “Global Patent Litigation: How and Where to Win”, 2016 Edition, Michael C. Elmer, C. Gregory Gramenopoulos, pg 21-11

[2] Life sciences includes:

Biotech: (C07G, C07K, C12M, C12N, C12P, C12Q, C12R, C12S) not A61K

Pharmaceuticals: A61K not A61K-008

Organic fine chemistry: C07C, C07D

[3] Jonathan Griffen, National Conference of State Legislatures, 6/15/2016, http://www.ncsl.org/research/financial-services-and-commerce/2015-patent-trolling-legislation.aspx

-

Previous:

-

Next: